Federated Learning is the AML breakthrough Regulators and FIUs have been waiting for

Every day, thousands of reports flood regulator and FIU systems, yet only a small fraction contain intelligence that drives investigations forward. In 2024 alone, U.S. institutions filed more than 4.7 million Suspicious Activity Reports, with banks spending an average of more than 21 hours preparing each SAR.

And that’s just the start. Across the industry, hundreds of millions of alerts are generated each year before a single SAR is ever filed.

So the real questions are these:

- ➡How many agents are needed to examine this vast quantity of suspicious activity?

- ➡How can agents get to the valuable reports?

- ➡How do filing organizations really know they are finding the true suspicious activity?

- ➡How do the agencies improve their efficiency and effectiveness?

- ➡How do agencies get a holistic view of what type(s) of suspicious activity are going on at various financial institutions?

Right now, most can’t. Reports sit in queues, mis-prioritised or poorly formatted. Reporting entities rarely hear back. Supervisors struggle to demonstrate effectiveness. And rare, but serious, typologies stay hidden when institutions work in isolation.

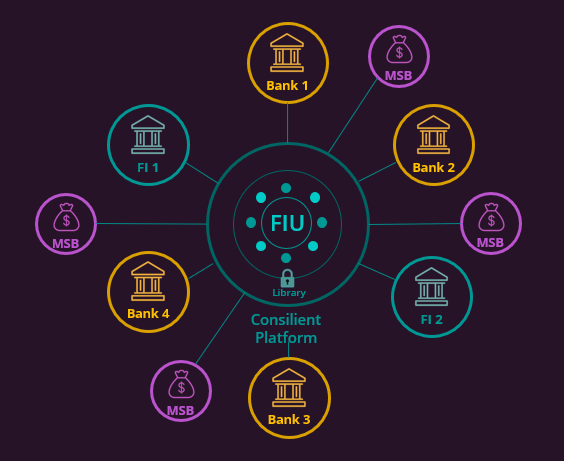

It is important to consider that criminals work in networks across the system. The industry and FIUs need to as well, it is vital to have an aggregate view across the system on financial crime.

Federated learning gives regulators and FIUs the collective intelligence they’ve been missing. Here’s how…

From one-way reporting to two-way intelligence

Every FIU knows the feedback shortfall is one of the weakest links in the AML chain. Millions of STRs are filed each year, but reporting entities rarely learn whether their submissions added value. This means Regulators are left with uneven quality, duplication across institutions, and little ability to guide improvements.

This is where Federated Learning steps in. It finally gives supervisors and financial institutions a way to make AML and CFT programs more intelligent, connected, and effective (without any data being shared).

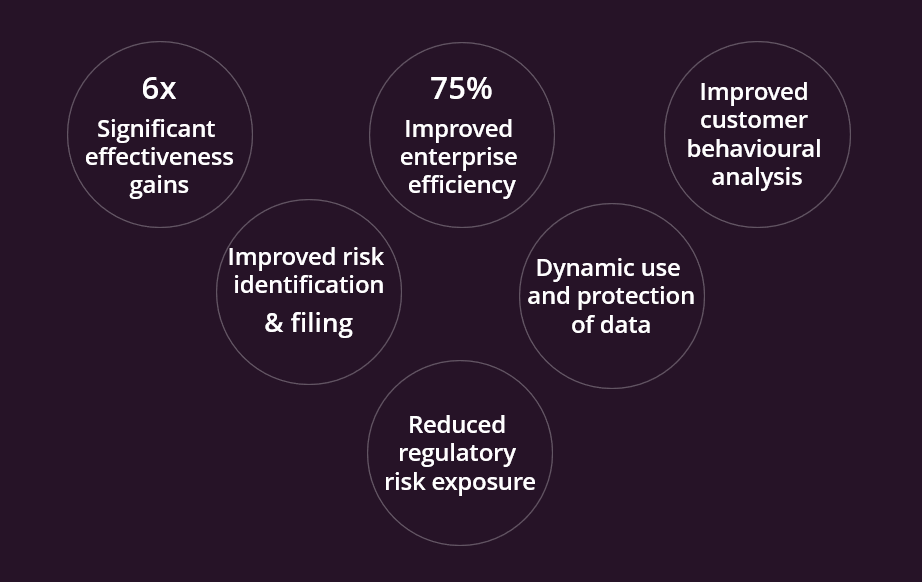

Crucially, federated learning helps supervisors prioritize the SARs that matter (the ones that drive investigations and direct resources to real risk). It shows which institutions add value and where support is needed to lift standards. With those insights, supervisors can refine typologies, sharpen categorization, and guide industry behaviour more effectively. And because models run locally, feedback is shared without ever exposing raw data.

The payoff looks like this:

- 🟣Sharper supervision with visibility into which institutions consistently file useful reports.

- 🟣Better alignment of resources by steering reporting toward risks that reflect supervisory and national security priorities.

- 🟣Stronger typology libraries built from shared learning across the ecosystem.

- 🟣Higher reporting standards across the board, from global banks to smaller MSBs and fintechs.

By fixing the broken feedback cycle, federated learning turns reporting from a compliance burden into a stream of actionable intelligence. And Consilient’s federated models are built to support exactly this: showing which reports matter, pushing those insights back to the network, and turning feedback into a repeatable process.

Where Federated Learning delivers immediate value

The strength of Federated Learning is that it’s not confined to a single use case. For regulators and FIUs, it can be applied across the full reporting and supervisory lifecycle, cutting across banks, MSBs, fintechs, and other obligated entities. Because the data never leaves the institution, Regulators can build collective intelligence without undermining privacy or breaching confidentiality laws.

Some of the most valuable applications include:

- Cross-institutional collaboration: Typologies identified by one institution immediately strengthen detection models for the rest of the sector. This solves the disadvantages firms face when new risks emerge.

- Real-time typology enrichment: Federated models continuously update as new behaviors appear in the system. This prevents typologies from becoming stale and ensures detection stays current with criminal innovation.

- Improved sector coverage: Regulators gain insight that cuts across diverse reporting entities. Patterns emerging in MSBs or fintechs, which might otherwise go unseen, can now be factored into system-wide intelligence.

- Trust-driven participation: Because institutions know their customer data never leaves their control, regulators can bring more players into the network, multiplying the intelligence available.

For Regulators, the opportunity is to move beyond static, red flag guidance, rules-based systems and into a model that learns directly from the ecosystem it supervises. The result? More data points, yes. But also a higher standard of risk detection that reflects the full spectrum of financial activity.

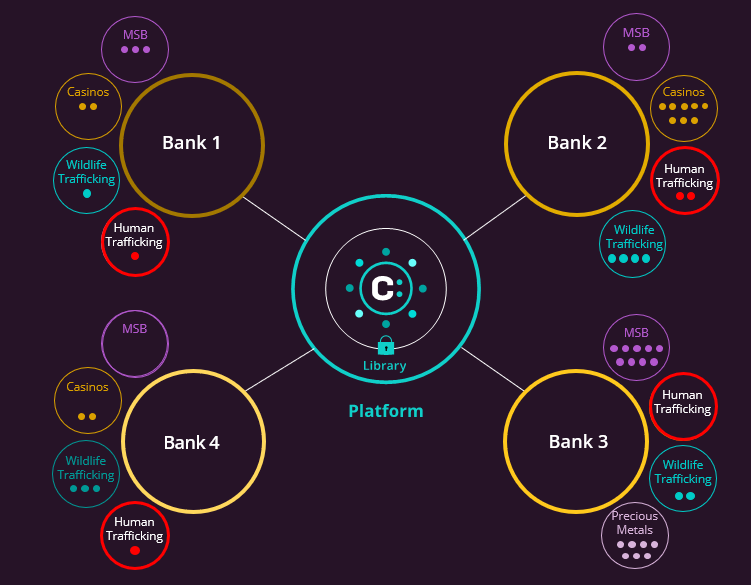

Finally making rare typologies visible

Human trafficking, deadly Fentanyl pushing, and high-value bribery rarely generate enough local data to be detected by a single institution. The trouble is, the rules that are written in isolation miss them, leaving Regulators exposed to the very risks FATF assessments focus on.

Again, Federated Learning breaks that barrier. By training across multiple institutions, it identifies the features of rare cases that no single dataset can surface. When one participant encounters a case, the signal strengthens the model for all. Smaller institutions benefit from intelligence usually available only to the largest players, while regulators gain visibility into threats that previously slipped through.

For Regulators and FIUs, the benefits directly hit operations:

- 🟣Rare typologies become detectable rather than invisible.

- 🟣Feedback improves targeting so resources can be directed to the highest-value cases.

- 🟣Shared learning lifts standards across the system, not just at the largest institutions.

And this is how Federated Learning turns rare cases from blind spots into actionable intelligence.

Raising the standard of every STR

Traditional STR monitoring systems often operate in isolation and rely on static rules or limited local data. The outcome is predictable: inconsistent filing standards, typologies that are missed, large volumes of false positives, and, in some cases, under-reporting of genuine risks. And for regulators, this means supervision is built on uneven intelligence, while investigative teams spend too much time sifting low-value material.

Supervisors can leverage Federated Learning to strengthen reporting to address each of these weaknesses. Models trained across multiple institutions highlight activity that is both relevant and actionable, and with Supervisor adding their training to the model, the AML/CFT regime becomes incredibly powerful. Improving the quality of filings, increasing the volume of reports where risks are being missed, and bringing consistency to reporting across sectors.

The difference it makes:

- 🟣Higher quality STRs: Models highlight relevant, actionable activity.

- 🟣Greater quantity: Detects under-reported or hidden risks.

- 🟣Cross-sector consistency: Aligns filing standards across banks, MSBs, FIs.

- 🟣Faster adaptation: Models adapt quickly to emerging threats.

Federated Learning lifts STRs above compliance requirements, giving institutions a defensible evidence base when effectiveness is tested.

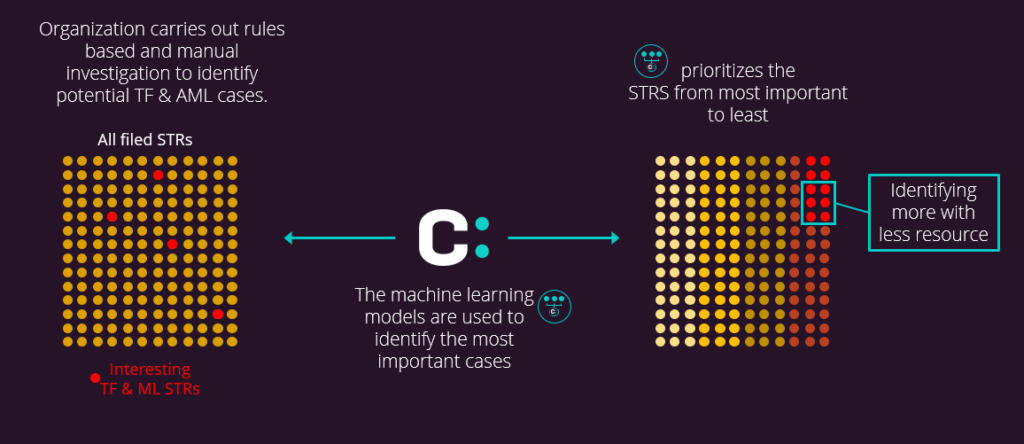

From backlogs to risk-based review

Backlogs and mis-prioritization remain one of the most visible weaknesses in supervision. STRs are often reviewed in the order they arrive, not according to the risk they represent. High-value cases are delayed, while analysts spend critical hours on filings that add little. The result? Slower detection and weaker enforcement outcomes.

The good news is that Federated Learning provides a way to prioritize reports according to risk. Pre-trained models can be distributed across institutions, running locally on their own data and adapting to each organisation’s risk profile. Because the data never moves, privacy is preserved while regulators benefit from a shared system that raises the standard of triage across the entire reporting population.

For Regulators and FIUs, this changes the nature of case review:

- 🟣Faster escalation of urgent risks: high-priority reports are surfaced quickly instead of waiting in line.

- 🟣More efficient use of analysts: effort is directed to cases most likely to produce intelligence.

- 🟣Improved crime identification: rare but serious threats are less likely to be buried under routine filings.

- 🟣Consistency in prioritization: institutions apply the same underlying logic, giving regulators a clearer view of risk across the sector.

This is how Federated Learning converts STR backlogs from a liability into an opportunity to prove effectiveness. We’ve seen first-hand the benefits of applying this approach for clients:

Proving effectiveness with metrics Regulators can defend

Regulators’ key indicators shouldn’t be judged on how many reports they collect, but whether those filings lead to detection, enforcement, and stronger cases. Federated learning provides the measurable outputs regulators need to demonstrate impact. We’ve covered some of these topics briefly already, but let’s pull them all together here:

| Focus area | What Federated Learning provides |

| STR supervision and feedback | Benchmarks on the accuracy and risk relevance of STRs. Shows which institutions consistently file useful reports and which may need intervention. |

| Early warning of emerging risks | Visibility into typology shifts or sector vulnerabilities before they escalate. |

| Cross-sector intelligence | Insights from banks, MSBs, and fintechs without accessing raw data, ensuring compliance with privacy laws. |

| Policy and guidance | Statistically grounded insights for regulatory updates, training, and FATF-aligned standards. |

| Effectiveness metrics and benchmarking | Measurement of which institutions file STRs that consistently add value, allowing supervisors to identify leaders and laggards. |

| Typology-specific feature identification | Identification of flows, counterparties, and customer behaviours most common in high-risk cases. |

| Escalation predictors | Recognition of STR characteristics statistically linked to investigations, prosecutions, or enforcement actions. |

Federated learning also strengthens collaboration by linking institutions domestically and FIUs internationally, without ever sharing raw data. It creates a single, privacy-preserving intelligence framework that helps regulators act faster and with greater confidence.

One thing we are incredibly proud of is that our federated platform is designed to support this kind of measurement, giving regulators a defensible way to benchmark reporting quality and provide feedback grounded in evidence.

The tools regulators and FIUs need for AML effectiveness

Filing volumes continue to rise, and resources are being stretched, which means regulators can’t measure effectiveness solely by activity alone. And when supervision still depends on static rules and siloed data, blind spots are inevitable.

That’s why Federated Learning is so important. Because it closes the feedback loop, it raises the quality of STRs. And because it prioritizes the filings that carry the most risk, it also brings rare cases into view. From there, collaboration stops being ad-hoc and becomes part of supervision itself.

Which means regulators end up with intelligence they can defend under review. And when effectiveness is judged by outcomes, federated learning is the tool that lets regulators and FIUs prove them.That’s exactly what Consilient is helping supervisors achieve today. So if you’re ready to see how, let’s talk.